Retirement Asset Optimization

deliver fully funded income plans with half the capital (on average)

- RAO is a retirement income planning powerhouse. With compelling messaging, proprietary software, and the strength of DMI’s advisor-first infrastructure, RAO turns planning into strategic, revenue-driving action while helping you easily convert clients and retain more AUM.

AS SEEN ON

POWERED BY ROTH BLUEPRINT SOFTWARE

ELIMINATING 6 TAX CHAIN REACTIONS WITH A TAX-FREE INCOME STRATEGY.

Show your clients and prospects how to facilitate Roth conversions without out-of-pocket expenses or account reduction. Roth Blueprint software is laser-focused on solving the “big IRA” tax problem, especially for clients who:

- Are in the 22% or 24% bracket

- Have $1M+ in qualified plans

- Can’t (or won’t) write checks to pay conversion taxes

A hypothetical $1 million IRA grows to $7.5 million tax-free by age 95 with a Roth Blueprint plan.

WHAT IS RAO?

Retirement Asset Optimization is an income planning turbocharger built on 3 pillars:

-

Asset Segmentation, Not Asset Allocation

Stop overfunding income plans. RAO uses segmentation to isolate income needs from growth objectives—eliminating the risk of dollar-cost-ravaging. -

Social Security Optimization

Quantitatively determine when and how to claim benefits for the highest guaranteed income, lowest tax exposure, and optimum capital efficiency. -

Guaranteed Income + Capital Efficiency

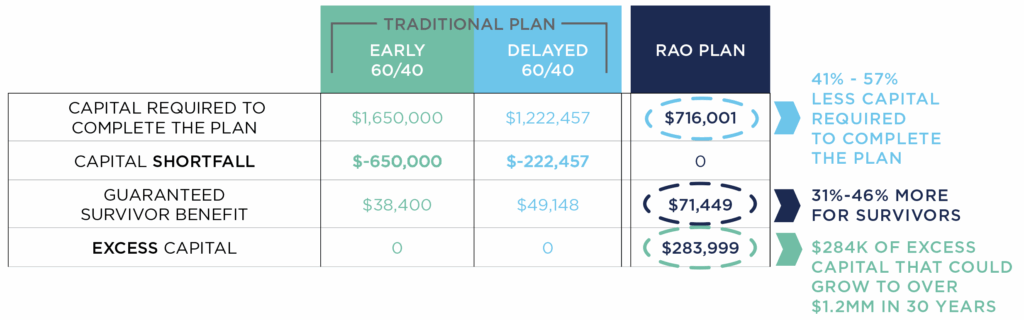

Leverage private contracts (like annuities) with inflation-protected income riders to deliver 100% guaranteed income for life, at a lower capital requirement than traditional 60/40 plans.

you asked clients what they want to do with their extra money?”

“With RAO, I’m delivering better outcomes with half the capital. When was the last time you asked clients what they want to do with their extra money?”

- Brian Donahue

DMI President & Founder

CASE STUDY SNAPSHOT: Traditional 60/40 Plan vs Optimized Plan

This is a hypothetical case study snapshot. Both clients are 66 and wish to retire at FRA. See the full case study for details.

Why Advisors Choose DMI + CSSCS

DMI’s exclusive partnership with THE Corporation for Social security Claiming strategies (CSSCS) gives financial professionals access to RAO AND:

You’re not the problem. The seminar model is.

- Advanced retirement income training and certification

- Proprietary retirement income planning tools & software

- Marketing and lead-gen support

- One-on-one case design consultation

- Annuity product access aligned with 21st-century planning

- Continuing education and programs

“This isn’t just another planning tool. RAO gives me a competitive edge and helps me keep my assets under management.”

- Brian Donahue

DMI President & Founder

Top Advisors. Real Results.

Real Advisors. Real Results.

23 Appointments in Two Nights

Using our full seminar system—mailers, scripts, steakhouse, and Roth strategy—this advisor walked out with 23 appointments and a $9M+ pipeline.

From On-the-Fence to $2.8M Closed

One advisor brought the software into a client meeting and let it speak for itself. The visual clarity sold the conversion—$2.8M closed, no friction.

Let’s Be Honest—This Isn’t for Everyone.

Let’s Be Honest—This Isn’t for Everyone.

- This system won’t work if:

- You’re writing less than $5M/year in annuities

- You don't have a marketing budget or a staff to help execute

- You’re not serious about targeting high-net-worth clients

- You’re hoping to coast or passively “get leads”

But if you’re a high-performing advisor ready to go bigger with smarter strategies, keep reading.

READY TO CRUSH IT?

Redefine retirement income planning for the 21st Century. Contact our Annuity Sales Team to see RAO proprietary software in action.

No pushy sales pitch. Contact our Annuity Sales Team to see if this system fits your practice.

- $2M+ cases closed with the software

- Seminar model that pays you back 30:1

- Full DMI support, training, and targeting included

RAO is a proprietary planning methodology of the Corporation for Social Security Claiming Strategies. Not affiliated with the Social Security Administration. For financial professional use only.

Although DMI may promote and or recommend the services offered by these third parties, we do not guarantee the accuracy or quality of their materials or services and accept no responsibility or liability for their services. Financial professionals are ultimately responsible for the use of any materials or services and must be aware of any and all applicable compliance requirements. Additionally, investment advisors are encouraged to seek pre-approval of the use of service and materials from their RIA or BD as applicable. Click here for full disclosure.