Solving for the LTC Blind Spot

Every advisor and agent has a few planning gaps that are easy to acknowledge… and even easier to postpone. Long-term care is the big one. Not because you don’t believe in it.Because the conversation tends to break down in the same predictable places: It gets emotional fast. It gets complicated faster. And clients hit you with the objection […]

Run Your Plan, Don’t Just Write It: The Business Plan You’ll Actually Execute

Most financial professionals don’t have a motivation problem. They have a traction problem. Because writing a plan and running a plan are two completely different experiences. One feels productive. The other creates results. And if we’re being honest, too many plans never make it off the “starting blocks.” Not because you’re not capable. Because the year starts fast… and the plan disappears. If you’ve ever looked up in March and thought, “How […]

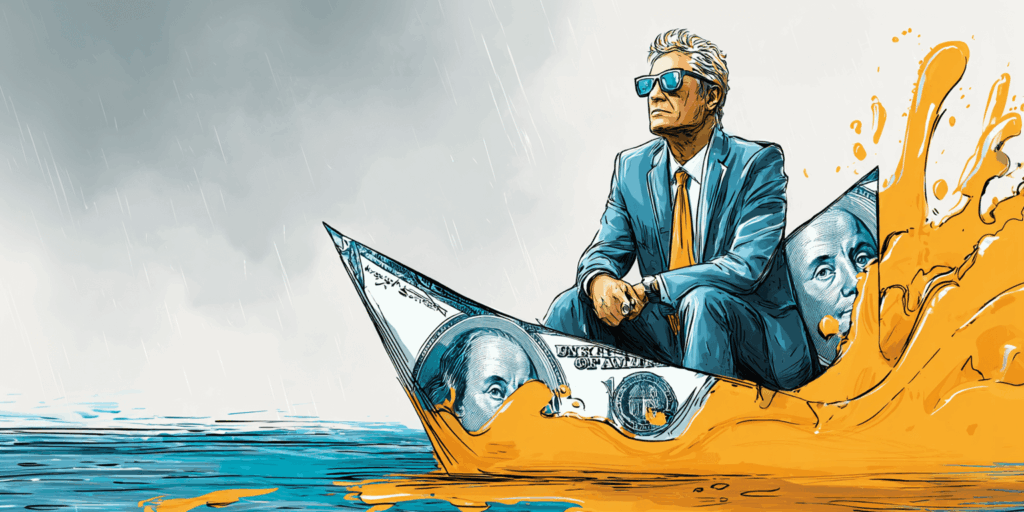

Timing the Tides

Retirement Success Depends on When Your Clients Set Sail Retirement isn’t just a destination—it’s a launch. And like any voyage, the timing of the tides matters more than most clients realize. In planning terms, that tide is the market. And if your clients set sail during a downturn, their portfolio may never find its way back. This isn’t a […]

The LTC Conversation You Can’t Keep Avoiding

There’s a moment every advisor knows too well. You’re building the plan, reviewing the assets, talking income strategies… and then you hit the section everyone tiptoes around: Long-term care. Clients get uncomfortable. You get cautious. And the conversation drifts to “We’ll look at this next time.” Except next time rarely happens. And when the need shows up […]

From Growth to Income: 5 Strategic Shifts

The Retirement Red Zone isn’t a metaphor. It’s a moment of truth. Your client is close to the goal — lifestyle freedom, no paycheck needed — but the field just shrank. The margin for error is gone. Sequence of returns, inflation creep, longevity risk — they’re all blitzing at once. And here’s the kicker: most […]

Income Reliability Over Portfolio Longevity: A New Standard for Advisors

Capital-intensive withdrawal strategies are obsolete. Modern financial planning demands purpose-driven, efficient solutions. Morningstar’s recent decision to lower its safe withdrawal rate from 4% to 3.7% isn’t a footnote — it’s a flashing warning light for financial professionals still building retirement income strategies around the portfolio longevity model. While the article “How’s Your Client’s Reliability of […]

The Care Crisis Your Clients Aren’t Talking About

WHY ASSET-BASED LTC DESERVES A PLACE IN YOUR PLANNING PLAYBOOK Long-term care (LTC) is one of the most overlooked threats to a retirement portfolio. Advisors often focus on market volatility, taxes, and estate transitions — but few give equal weight to the financial shock a care event can cause. The statistics are hard to ignore: […]

Death, Taxes… and the 6 Silent Wealth Killers

DMI’s Exclusive Roth Blueprint Turns RMD Chaos Into Tax-Free Clarity We all know the two things no one escapes—death and taxes. But there’s a third beast lurking in your clients’ future, and it’s quietly feasting on their legacy: the six chain reactions triggered by Required Minimum Distributions (RMDs). And here’s the real kicker: most advisors […]

Retirement’s Curveballs — Here’s How Top Advisors Are Hitting Back

Volatile markets. Shrinking withdrawal rates. Uncertain Social Security.Today’s retirement isn’t playing by the old rules—and neither should your strategy. The top advisors aren’t playing defense anymore. They’re leading with a new benchmark for income planning. It’s simple to explain. Powerful to deliver. And engineered for the real-world risks your clients actually face. RETIREMENT HAS BECOME […]

You’re Already in the Room. OWN ALL OF IT.

Why Employee Benefits Advisors Are Leaving Revenue—and Relationships—on the Table As an Employee Benefits Advisor (EBA), you’ve already done the hard part. You’ve earned a seat at the table.You’ve built trust with business owners.You’re the go-to for health, dental, and employee benefit renewals. But if that’s where the conversation ends, here’s the truth:You’re doing half […]