Volatile markets. Shrinking withdrawal rates. Uncertain Social Security.

Today’s retirement isn’t playing by the old rules—and neither should your strategy.

The top advisors aren’t playing defense anymore. They’re leading with a new benchmark for income planning.

It’s simple to explain. Powerful to deliver. And engineered for the real-world risks your clients actually face.

RETIREMENT HAS BECOME A FULL-CONTACT SPORT

Let’s be honest—your clients are facing curveballs from every angle:

- 📉 A safe withdrawal rate that just dropped to 3.7% according to Morningstar

- 🏛️ A future where Social Security may be reduced

- ⏳ Lifespans that routinely stretch into the 90s

- 💸 Market downturns that derail retirement income strategies at the worst possible time

“Today’s advisors aren’t just managing portfolios. They’re managing uncertainty, longevity, and legislation—all at once.”

—David Blanchett, Morningstar Retirement Researcher

The stakes are higher. The margin for error is thinner.

But there’s a strategy that’s changing how top advisors are delivering growth, protection, and peace of mind—all in one powerful, fiduciary-aligned solution.

👉 See the full strategy live on July 22. Register now: https://dmiuniversity.com/the-iul-designed-for-fiduciaries

THE PORTFOLIO ADVANTAGE: SHIFTING THE EFFICIENT FRONTIER

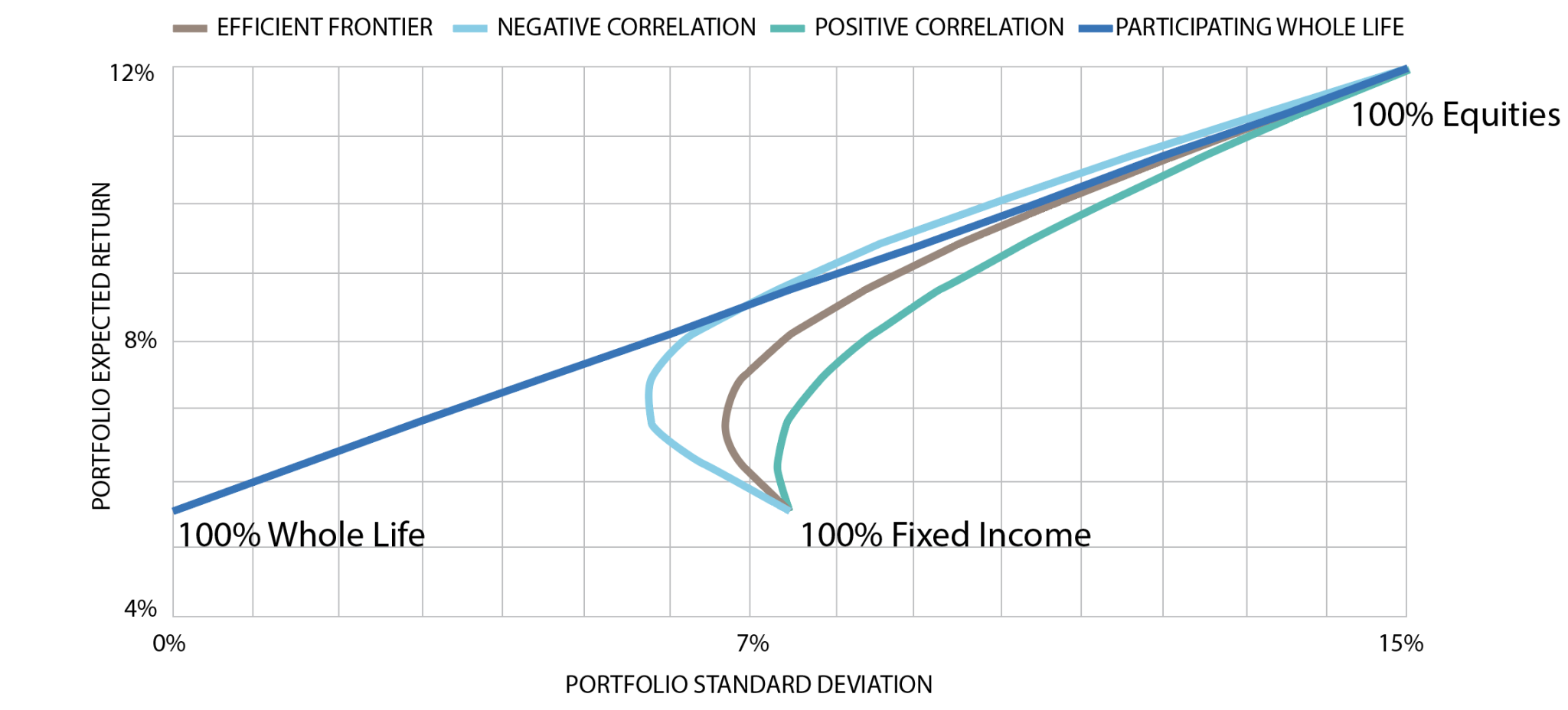

For advisors trained in modern portfolio theory, there’s a surprising truth most haven’t explored deeply: adding a life insurance asset—like an IUL or whole life policy—can shift the efficient frontier upward.

Modern Portfolio Theory & Life Insurance

Why?

- Low Correlation to Equities: IUL values don’t drop when markets do. That non-correlation helps smooth portfolio volatility.

- Tax-Free Access: Policy cash value can be tapped tax-free, improving overall after-tax efficiency.

- Behavioral Edge: When markets crash, clients don’t have to sell stocks for income—they can draw from the IUL, keeping their equities compounding.

“When designed properly, permanent life insurance can act as a non-correlated asset that enhances the risk-adjusted return of a portfolio.”

—Wade Pfau, Professor of Retirement Income, The American College

By reallocating a portion of fixed-income exposure into IUL—especially in a low-yield environment—you can maintain downside protection while boosting potential upside, all while softening sequence-of-returns risk.

This isn’t theoretical. Advisors are using it now to create more resilient income plans—and smarter accumulation strategies.

In a world where traditional 60/40 portfolios are no longer delivering, adding IUL to the mix doesn’t just reduce risk—it expands possibility.

BUILT FOR CURVEBALLS, NOT JUST FASTBALLS

This isn’t just a competitive IUL—it’s a modern retirement strategy engineered for excellence, with features that aren’t bolted on, but built in.

Here’s how it helps you address the new realities of retirement planning:

🚀 410% Participation Potential

Capture market upside with uncapped index options—and a 0% floor.

Your clients stay in the game, even when markets wobble.

🔁 LifePay Income Benefit

Provide clients with guaranteed monthly income for life, using the Longevity Benefit Base.

It’s the kind of consistent cash flow retirees crave—without relying on annuities.

🛡 PlanGap® Benefit

What happens if Social Security is cut?

This policy automatically triggers monthly income for 12 years if benefits are reduced by 3% or more. That’s not a rider—it’s embedded protection.

🏆 Enhanced Death Benefit

Clients want to leave more behind.

This strategy can increase the legacy payout to up to 120% of the base death benefit.

⚙️ Dual Trigger Strategy

Markets don’t need to boom to produce value.

Clients can earn 8% if markets are flat or up, and still 2% if they drop (as low as -10%).

💡 150% Benefit Base Growth

Earnings are credited at 150% to a protected benefit base.

That powers stronger income for the long haul—especially in low-rate environments.

Designed for Fiduciaries. Made for Results.

This isn’t just about features. It’s about alignment.

This IUL was built for professionals who lead with integrity and expect more from the products they recommend.

Whether you’re an insurance agent, investment advisor, or hybrid rep, this solution:

- Delivers transparency and simplicity

- Provides real-world outcomes clients understand

- Strengthens portfolios, income plans, and legacy strategies

And because it’s easy to explain—it’s easier to close.

“This is the first IUL strategy I’ve seen that speaks directly to the retirement risks we actually talk about with clients—longevity, market timing, income, and Social Security.”

—Brian Donahue, DMI President & Founder

See It in Action

If you’re ready to stop over-explaining complex hybrids, riders, or mismatched products…

If you want a single, powerful solution that simplifies the conversation…

If you’re committed to best-interest planning that drives better results…

📅 Then join us on Monday, July 22 at 12 PM ET for a live, no-fluff strategy session designed for professionals like you.

You’ll learn:

- Industry-best growth potential with downside protection

- SecureStage Benefits add new dimensions to income and legacy planning

- Why top advisors are rethinking the bond sleeve with IUL as a fixed-income alternative

- How to turn curveballs into client confidence and long-term trust

Claim your seat for our exclusive webinar: The IUL Designed for Fiduciaries.

Bottom Line

Your clients don’t care about products. They care about results & a winning game plan.

They want income they can’t outlive, protection from uncertainty when the knuckleballs come, and peace of mind that their retirement is safe—no matter what the market or Congress throws next.

This strategy is the new benchmark—your cleanup hitter in a world full of curveballs. And the advisors who step up now? They won’t just stay in the game—they’ll dominate the scoreboard.

JOSHUA RHEM

VICE PRESIDENT – LIFE SALES

Joshua Rhem brings 15+ years of experience in insurance and investment services, including roles as an RIA, producer, and wholesaler. He’s passionate about making insurance a core pillar of smart financial planning—and laser-focused on helping advisors turn obstacles into opportunities. Whether it’s strategy, support, or swift answers, Josh shows up ready to help brokers, agents, and advisors grow their business and deliver real value to clients.

Or Call 781-919-2325