Most discussions surrounding the sunset of the TCJA have focused on ultra-wealthy clients who have long been aware of their potential estate tax obligations. However, another group—those approaching the $20 million mark—will soon face this issue head-on for the first time come January 2026. For example, clients presently valued at $20 million could see their worth exceed $23 million by then, potentially finding themselves with an estate tax liability of over $4MM, absent other planning.

WHY THE SUDDEN CONCERN?

Before the TCJA, the estate tax exemption stood at a robust $5.45 million for individuals and nearly $11 million for married couples in 2016. Clients now worth $20 million were likely just over this threshold back then. Despite weathering economic fluctuations, including the impact of COVID-19, and witnessing substantial growth in their net worth, they are now facing the reality that their assets could exceed the exemption by as much as $9.6 million post-sunset—unless Congress intervenes.

These clients may have noticed how swiftly estate tax laws can change over a brief period. This uncertainty may incline them towards a wait-and-see approach, hesitant to commit significant time and resources to planning. Unless, of course, you show them a tailored strategy designed precisely for this demographic—a solution that balances cost-effectiveness, minimal commitment, and maximum flexibility.

This strategy incorporates three critical elements:

- Gradual Approach: Clients can opt for a phased insurance policy approach, initially crawling into a $5 million policy with a modest premium commitment.

- Protection and Growth: The policy doubles to $10 million in coverage for the first four years, shielding potential estate inclusions during this critical period.

- Future Flexibility: There’s an option to increase coverage by up to an additional $5 million between January and June 2026, providing flexibility as circumstances evolve.

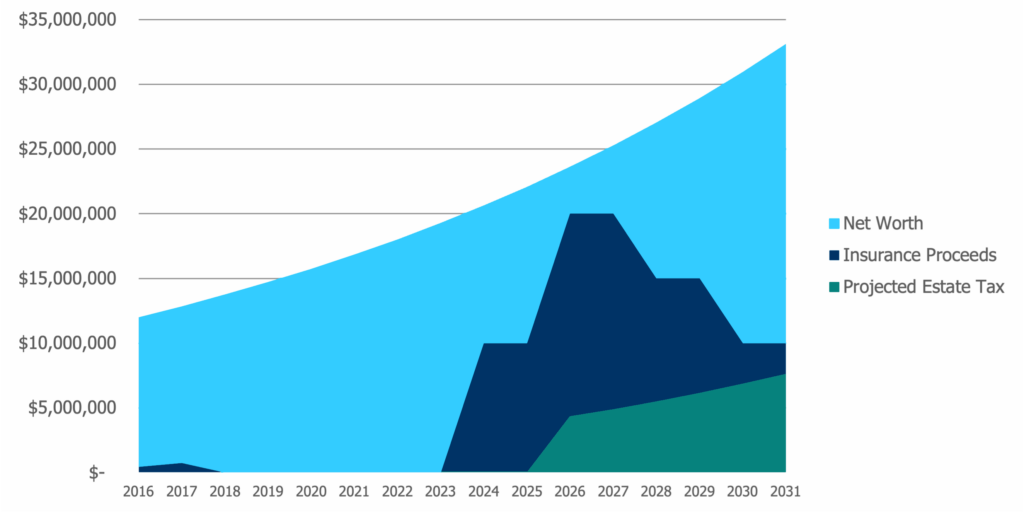

Figure 1 illustrates the trajectory from 2016 to 2031, projecting a net worth growth from $12 million to over $33.1 million and a potential estate tax liability nearing $7.6 million by 2031 without Congressional action.

Growth of a hypothetical client’s net worth from $12MM in 2016 to over $33.1MM by 2031, as well as their projected estate tax liability of nearly $7.6MM. Without action, that potential bill will continue to grow each and every year as their net worth grows.

However, if that same client pursued the strategy described above, their insurance design has them well positioned. It buys them time to complete the estate planning work that becomes now well worth the time and money it will take to complete upon the sunset. Figure 2 adds the insurance proceeds over the same period described above.

The insurance amounts include the doubling of the face amount in the first four policy years for both policies referenced above. This results in coverage amounts as follows:

- Year 1: $10MM

- Year 2: $10MM

- Year 3: $20MM (Assumes execution of purchase option)

- Year 4: $20MM

- Year 5: $15MM

- Year 6: $15MM

- Years 7+: $10MM

FIGURE 2: Growth of Net Worth, Potential Estate Tax Liability, and Insurance Coverage

Implementing a “crawl-in” insurance strategy over the same hypothetical time period can strategically align with evolving needs, offering a safeguard against escalating tax liabilities.

By embracing this approach, clients achieve two key objectives: maintaining maximum flexibility and minimizing immediate financial commitments. Although cost-effectiveness remains a primary consideration, initial premiums as low as $55,000 over two years for a pair of 65-year-olds can initiate this safeguarding process, albeit insufficient for long-term $10 million coverage. Nonetheless, it provides a starting point for deeper estate planning discussions while averting exposure to potentially substantial tax liabilities.

This strategy serves as a pivotal example of proactive estate planning amidst an uncertain legislative landscape, offering clients tailored solutions for navigating potential tax challenges ahead. It’s just one example of the strategies available to help clients plan for an uncertain estate tax planning future.

Assumptions include: 3% inflation rate for the estate tax exemption, estate tax rate increase to 45% in 2026, 7% growth rate on client net worth.

The contents of this document should not be considered as tax or legal advice. Any information or guidance provided is solely for educational or informational purposes and should not be relied upon as a substitute for professional advice. It is always recommended to consult with a licensed financial or legal advisor for specific guidance related to your individual situation.

No one ever wants to be late to a party… especially this one. The Tax Cuts and Jobs Act (TCJA) sunset seems a long way off but proper planning begins now.

SIMPLIFYING SUNSET: Use it or Lose it

Join us on August 14 at noon, ET, and get the information you need to best advise clients:

- How to talk with clients about the urgency of planning now

- Advanced planning strategies to avoid excessive estate and income taxes

- Tax efficient strategies to create a legacy

- Proven ways to win bigger cases in the business owner market

JOSHUA RHEM

VICE PRESIDENT – LIFE SALES

Joshua Rhem has over 15 years of experience in Insurance and Investment services, with experience as an RIA to financial institutions, an insurance producer, and wholesaler. Throughout his career Joshua has always been especially interested in making sure that insurance is viewed as a vital component of a well-constructed comprehensive financial plan. Understanding the obstacles that advisors face each day, Josh is eager to support them, and promptly responds to their needs. He enjoys helping advisors, brokers and agents grow their business with strategies to identify opportunities and helping to effectively position insurance products as meaningful solutions to their clients’ financial goals.

Or Call 781-919-2325