Tips for market volatility impacting clients at or near retirement

Due to the unpredictability of the stock and bond markets, it’s quite possible that a traditional asset allocation strategy may not protect clients from declining asset values and could potentially expose them to an even bigger risk: running out of savings in retirement. After all, costs of living are on the rise, and people are living longer than ever. In fact, it’s estimated that about one out of every four 65-year-olds today will live past age 90, and one out of 10 will live past age 951.

It’s becoming an increasingly difficult challenge to make retirement savings last as long as clients do.

Let’s look at a typical couple, who we will call the Smiths. Suppose they have $500,000 in retirement savings when they retire at age 65. They plan to withdraw 4% ($20,000) of their initial savings per year, which are currently allocated to 60% equities and 40% bonds.

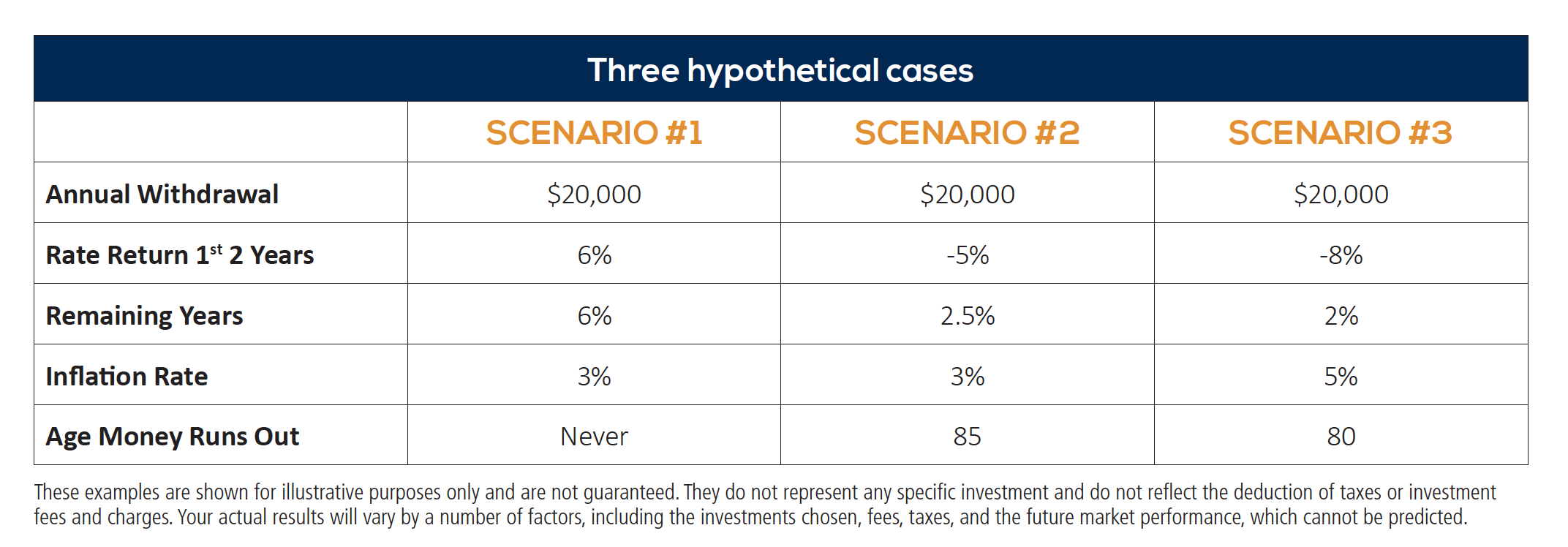

Here are 3 hypothetical scenarios they may experience.

-

- An ideal retirement with steady returns (no volatility) and average inflation.

- Below average market returns and average inflation.

- Below average market performance and higher than average inflation.

How long will retirement money last in each scenario?

Scenario #1

In this case, the Smiths never run out of money — they truly hold the winning hand!

This example assumes no market volatility, steady growth of 6%, and inflation at the historical average of 3%. The couple’s principal remains and actually increases over time.

As anyone who lived through the volatile economy of the last decade knows, these conditions are unlikely to materialize, and you probably wouldn’t want to bet on it.

Scenario #2

This example assumes a slight bear market in the first two years (5% annual decline), followed by a 2.5% growth rate and average inflation.

When 3% inflation is factored in along with 2.5% growth, the Smiths would actually yield a slightly negative (0.5%) return from year three onward. This may seem improbable but consider the real rate of return for the S&P 500 between 1970 and 1979 was actually -1.4%, anything is possible, and the Smiths would be out of income by age 85.

Scenario #3

In this case, a deeper bear market in the first two years (8% annual decline) is followed by sluggish growth (2% annually) in subsequent years. It also assumes an up-tick in inflation to 5%, which was about the average for the 1980s.

This results in an annual return of -3% from year three onward. While this seems like a drastic scenario, the S&P 500 actually fared worse than that (-3.4%) when you take inflation into account for the period from 2000–2009.

In this example, the Smiths would be out of luck (and money) by age 80. Though unlikely, would you be willing to bet a client’s retirement nest egg that it won’t happen?

Bear markets near retirement can be a threat to your client’s financial future.

BEWARE OF THE BEAR… MARKET

Traditional asset allocation can be affected by a “bear market,” typically defined as a downturn of 20% or more lasting at least 60 days. A bear market can eat away at the stock and bond portion of a retirement portfolio. History shows us that since 1929, the U.S. stock market has experienced 25 bear markets, an average of one every 3.41 years. And while this past performance doesn’t offer any promises of what’s to come, depending on how your assets are invested, it could take years for a portfolio to recover!

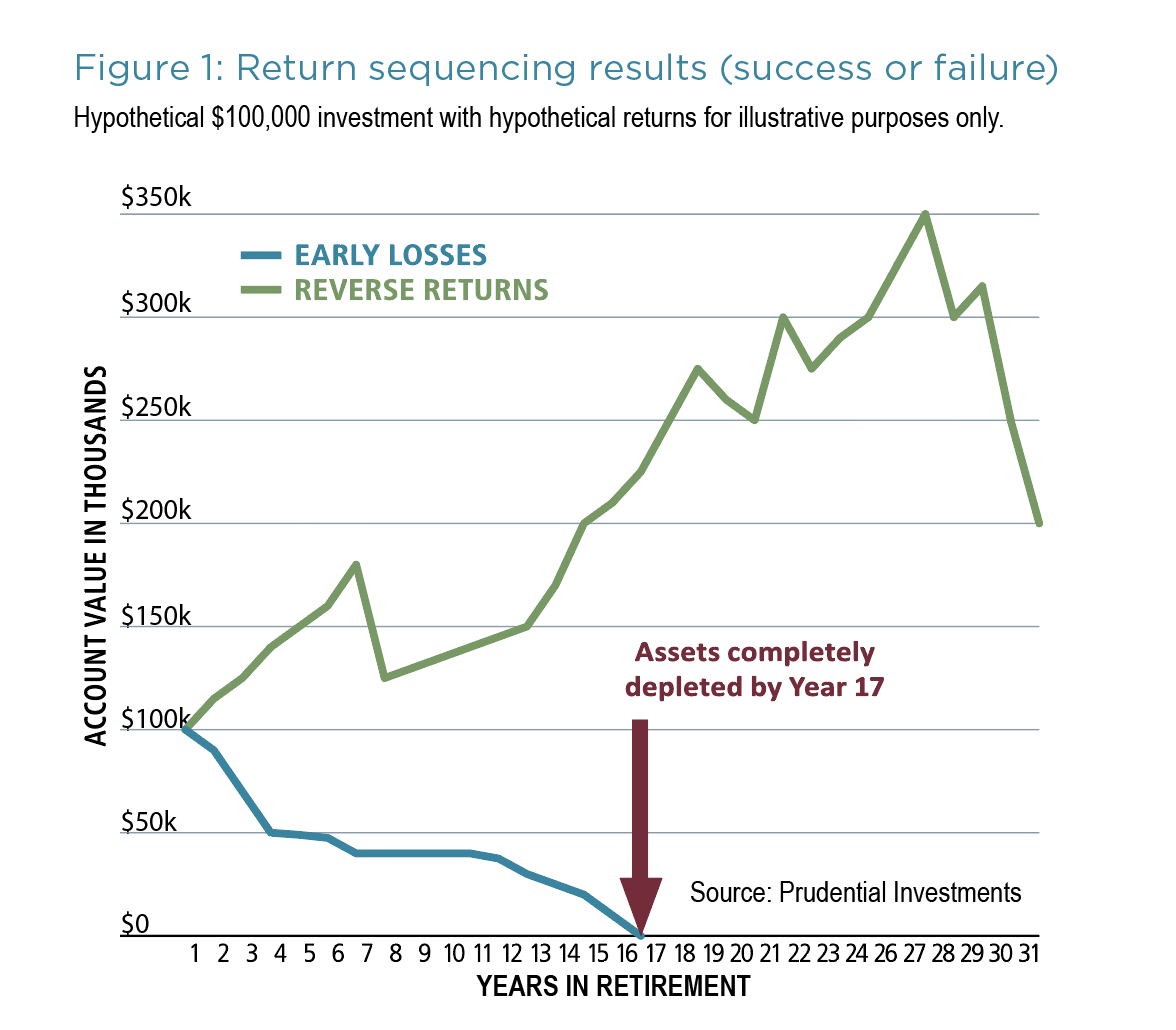

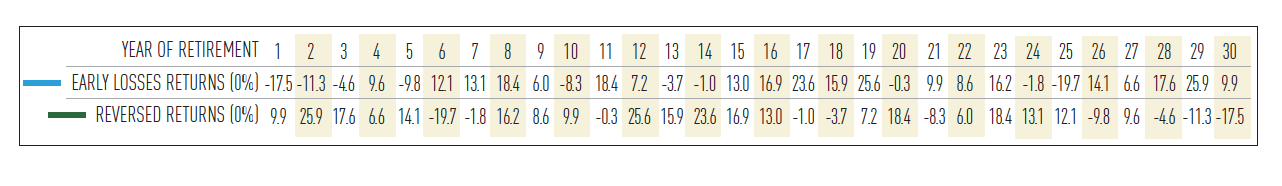

In Figure 1, simply reversing the order of the returns (or the sequence of those returns) creates two vastly different outcomes. The portfolio with ‘early losses’ is depleted by year 17 while the portfolio with ‘reversed returns’ lasts for 30 years and increases in value. Same returns, different order.

Clients retiring or approaching retirement in or near a bear market need to think about “sequence of returns” – that is, the risk of experiencing losses in your portfolio just as you retire. Withdrawing money from a portfolio while it’s declining in value can dramatically impact its ability to last throughout retirement (this is especially true if clients are planning for a retirement horizon that could last decades).

Don’t Let Portfolios get Bitten by the Bear

To help offset Sequence of Returns Risk, consider incorporating a time-tested wealth preservation strategy using FIAs to help protect client nest eggs and generate income for life. FIAs are a diverse financial planning tool. DMI can supply you with the resources you need to identify the appropriate product for each client. We can also provide consumer-facing educational materials and illustrations to help make the case that an FIA might fit their needs.

With today’s market volatility and the Bear Market looming at every client’s Retirement Picnic Table, join Erick Lindewall, VP Sales at DMI, as we dive into Sequence of Returns Risk.

- What is it and how do you explain it?

- Why is the threat to retirement portfolios becoming reality?

- How do you help pre-retirees?

JOIN US JULY 13

registration closed – event ended

1 https://www.cnbc.com/2018/01/12/failing-to-plan-for-longevity-can-hurt-your- finances.html#:~:text=%E2%80%9CAbout%20one%20out%20of%20every,the%20Society%20of%20Actuaries%20reports.