Think back to when you graduated college. Do you remember how much it cost a year? Did you pay for it or have help paying for it? Did you have loans or grants to help offset the cost? Planning for the cost of college is important for those investing in higher education.

As a Vice President of Life Sales at DMI, I’m often asked by our partner agents and advisors: “ How can I help my client’s plan and pay for college cost? Fixed Index Life Insurance (FIUL) may be a great way to help offset some of the college costs for your clients.

In 2021, the average in-state tuition per year is $9,308; the average out-out state cost of college is $23,427. The average private university student spends a total of $53,102 per academic year, $35,801 of it on tuition and fees. (Source: EducationData.org)

With some early financial planning, DMI can design a plan for your clients to help them with college planning cost.

Considerations For Funding College Costs with a Fixed Index Life Insurance Plan

Prior to setting up a FIUL Plan to cover college expenses, you will need to note a few requirements:

- Parents of college students or the individual who is paying college costs such as an adult student will need to have double the face amount that you can apply that is requirement that insurance carriers require.

- The life insurance policy can NOT be a Modified Endowment Contract (MEC). The life insurance policy needs to stay complaint with the 7702 rules. A resource on changes to the 7702 is available from Mutual of Omaha.

Fixed Index Life Insurance Applied to College Planning Example

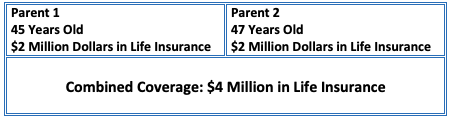

To best demonstrate the use of FIUL for college planning, let’s look at a common scenario and two examples – a $400 a month investment or a $600 a month investment – to demonstrate how life insurance can support college planning. Two parents just had a baby a month ago. They want to start saving money for college. Let’s review their specifics.

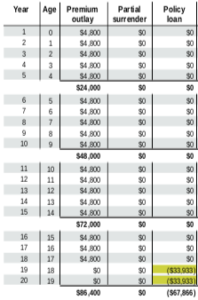

Saving for College for $400 a month

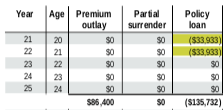

The parents put away $400 a month into a FIUL product for 17 years, then they can take out $33,933 a year in the form of a loan, which is tax free money to the parents. This would be a grand total of $135,732 in total money coming out as a loan over the course of 4 years.

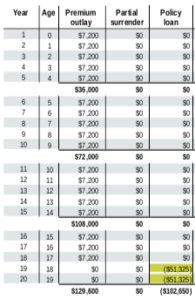

Saving for College for $600 a month

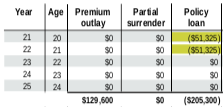

These same clients decide they can save $600 a month. What is the impact on their college planning with an additional $200 in the FIUL. The client would invest $600 a month for 17 years and then take a tax-free distribution in the form of a loan. This would result in a distribution of $51,000 a year for 4 years or a grand total of $204,000 toward college planning.

Please note the illustrated rate on both examples is 5.43%, which is compliance with the AG-49 A ruling. The AG-49 A ruling states that life insurance illustrations are no longer able to quote over 6% illustrated rate on life illustrations. Example illustrations have been sourced by the NAIC Index Universal (IUL) Illustration.

Both examples use the Securian BGA product for illustration purposes showing the crediting option in the 1-year Prism crediting strategy and showing a 5.43% return.

Saving for College with an FIUL– Life Factors

A Delay or Non-Attendance of College

What happens if your child decides to change their college plans? What if 2 years into the 4-year college the child doesn’t want to go to college anymore? Or your child decides to pursue alternatives to a college education. That’s a great and common question.

Each year parents or those insured would request a policy loan from the life insurance policy, so if after 2 years the child decided that they no longer want to attend college, the parents would stop taking out the policy loan. Simple as that.

Federal Financial Aid Impact on FIUL

But what are the implications for Financial Aid or the Free Application for Federal Student Assistance (FAFSA) form? How will this all work out when your client and their student applies for Financial Aid? Another great question. The answer is simple: life insurance is considered a non-reportable asset on the FAFSA form.

Planning For College Later in Life

If your client says: “I don’t have 17 years to accumulate money for college, what are my options?” A FIUL can still help them save. As part of the client/agent advisor relationship you have to meet the client where they are in their saving process. DMI is happy to work with partner agents and advisors to build a tailored plan to their client’s unique needs.

Conclusion

A FIUL is a great solution for clients of all ages to start saving for higher education. Consult your DMI Life Insurance representative to learn more about college savings and the use of FIUL to support college planning.