As we wrap up 2024, it’s clear the Indexed Universal Life (IUL) market continues to gain serious traction. LIMRA recently reported that the IUL market saw $3.7 billion in new premium in 2024 alone, with a significant portion directed toward protection-focused IULs. This trend is driven by a rising client demand for products that deliver both growth potential and robust death benefit protection.

KEY POINTS

1. Protection + Performance

The John Hancock Protection IUL, combined with the Annexus Prism Booster Strategy, offers a unique blend of competitive premiums, extended guaranteed death benefits, and consistent positive returns. This product is ideal for clients seeking both robust death benefit protection and growth potential in a single policy.

2. Resilience During Volatility

Designed to reduce market risk, the Annexus Prism Booster provides downside protection, helping clients avoid major losses during downturns while maintaining steady cash value growth. This makes it a stable choice for clients, particularly those nearing retirement who need reliable financial security.

3. Flexibility for Future Needs

The John Hancock Protection IUL also provides clients with flexible access to accumulated cash value, which can be used for retirement income, education expenses, or other financial needs. This versatility makes it a valuable asset that adapts to changing life stages.

WHY THIS MATTERS FOR YOUR CLIENTS

When it comes to life insurance, many clients today expect more than a traditional death benefit—they want a solution that combines financial growth potential with reliable protection. The John Hancock Protection IUL, enhanced with the Annexus Prism Booster Strategy, has been crafted to offer both of these essential features. Here’s a closer look at how this powerful combination can help you meet your clients’ diverse financial needs:

- Competitive Premiums without Sacrificing Value

This product is designed to keep premiums affordable without compromising the strength of the death benefit or cash value growth. For clients, this means they’re getting a competitively priced life insurance option that also works as a financial tool for the future. In a financial landscape where cost efficiency is increasingly important, this protection-based IUL allows clients to maximize their insurance dollar.

- Extended Guaranteed Death Benefit for Long-Term Security

One of the standout features of the John Hancock Protection IUL is the longer length of the guaranteed death benefit. This is especially valuable for clients who are planning for the long haul and want to ensure that their loved ones receive financial security, no matter what the future holds. The extended death benefit guarantee can be particularly appealing to clients seeking permanent protection rather than just temporary coverage, making this a solution that can help them achieve long-term peace of mind.

- Consistent Positive Index Returns for Steady Growth

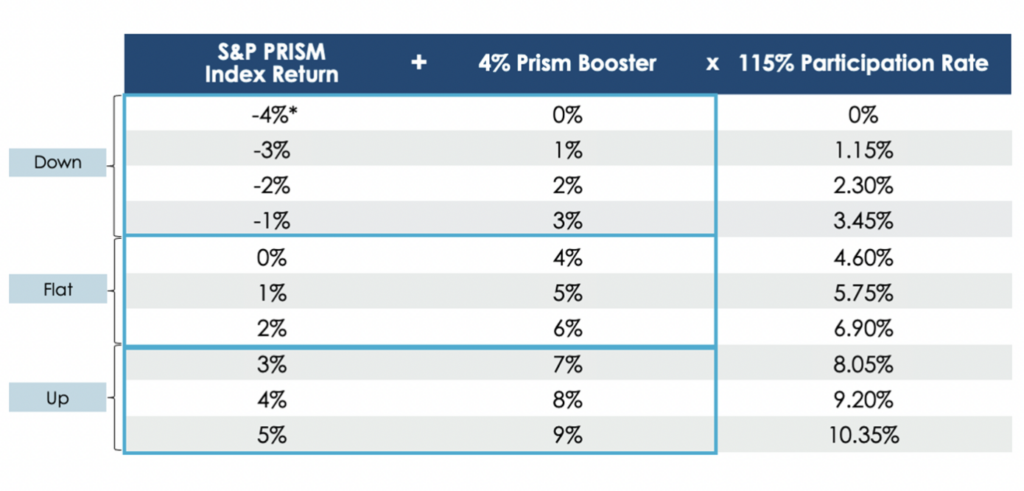

Market volatility is a common concern for clients, especially those who may be hesitant to rely on equities or traditional investment products. The Annexus Prism Booster Strategy addresses this by striving for consistent, positive returns, even in challenging market conditions. By smoothing out some of the fluctuations and reducing the frequency of zero-return years, the Prism Booster helps build cash value more predictably. This “positive credit” feature, which can provide growth even when the index is slightly negative, means your clients are less likely to experience stagnation in their policy’s cash value, supporting a steady accumulation of funds over time.

- Downside Protection Against Market Volatility

Unlike typical investment vehicles, which may expose clients to market downturns, this Protection IUL offers the reassurance of downside protection. In times of market uncertainty, the policy’s cash value remains shielded from major losses, giving clients the confidence that their cash value growth is less susceptible to market risks. This makes the product especially attractive for clients approaching or planning for retirement who want the assurance that their policy’s cash value will remain stable despite market fluctuations.

- Flexible Options for Future Financial Planning

With an IUL that provides both protection and cash value growth, clients have the flexibility to access the accumulated cash value as a source of funds for future needs, such as supplementing retirement income, paying for education, or covering unexpected expenses. This dual-purpose feature appeals to clients who view life insurance as a financial asset that can adapt to their changing life stages.

HOW THIS SOLUTION STANDS OUT

The combination of John Hancock’s Protection IUL with the Annexus Prism Booster Strategy is about more than just insurance—it’s about helping clients balance growth potential with protection in a way that is strategic and reliable. For clients seeking stability and growth within a life insurance product, this IUL solution can be a perfect fit, providing them with long-term protection, dependable cash value growth, and flexibility for future financial planning.

A SOLUTION FOR STABILITY IN ANY MARKET

The need for financial products that can perform steadily in both up and down markets is at an all-time high. The John Hancock Protection IUL with Annexus Prism offers precisely that—a solution engineered to reduce the impact of market volatility. The combination of consistent positive returns and downside protection means clients can potentially build more reliable cash value growth over the years, even if markets fluctuate.

WHAT THIS MEANS FOR YOU AS A FINANCIAL PROFESSIONAL

For financial professionals, this solution offers a compelling opportunity to deepen client relationships and provide a comprehensive life insurance strategy that meets both protection and growth goals. As client interest in protection-based IULs rises, this product enables you to position yourself as a trusted advisor who can offer tailored solutions designed to meet today’s financial realities.

READY TO LEARN MORE?

On Wednesday, November 20th at 12 p.m. Eastern, we’re hosting a webinar to delve deeper into the details of this innovative protection IUL solution and the benefits of the Annexus Prism booster strategy. Join us to explore how this powerful combination can help you deliver better outcomes for your clients and meet the rising demand for growth-focused, protection-oriented IULs.

Register today, and let’s continue providing solutions that bring real value to your clients and help secure their financial futures.

What do you get if you take the #1 selling death benefit IUL and add cutting-edge indexes and strategies? You get protection plus performance for clients that want growth AND a legacy.

- More consistent positive index returns

- Greater stability in the product design

- Additional policy flexibility

- Create additional asset value

JOSHUA RHEM

VICE PRESIDENT – LIFE SALES

Joshua Rhem has over 15 years of experience in Insurance and Investment services, with experience as an RIA to financial institutions, an insurance producer, and wholesaler. Throughout his career Joshua has always been especially interested in making sure that insurance is viewed as a vital component of a well-constructed comprehensive financial plan. Understanding the obstacles that advisors face each day, Josh is eager to support them, and promptly responds to their needs. He enjoys helping advisors, brokers and agents grow their business with strategies to identify opportunities and helping to effectively position insurance products as meaningful solutions to their clients’ financial goals.

Or Call 781-919-2325