Retirement can be tough. Your clients approaching retirement face a series of high-stakes decisions… like when to start taking Social Security benefits. It’s time to start boosting your client’s risk-protected retirement income with a strategy for optimizing Social Security — a ‘Bridge Plan.’

If you’re any kind of wealth manager, insurance agent, or financial advisor, it’s vital that you have a deep understanding of Social Security & Bridge Capital so you can not only get the best outcomes for your clients, but for your business, too.

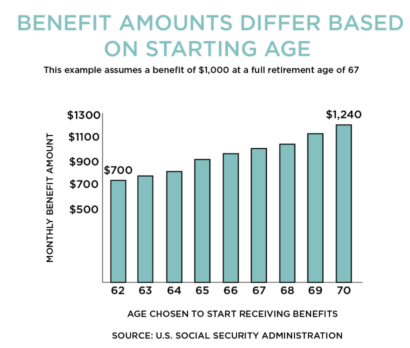

A retiree’s Social Security benefit can increase by as much as 76% [without including COLAs] between the ages of 62 and 70, according to research conducted by the Center for Retirement Research at Boston College.

WHAT IS A SOCIAL SECURITY BRIDGE

A Social Security Bridge refers to a strategy using other income sources to bridge the gap between early retirement and when clients start claiming Social Security benefits. By using other capital as a stopgap until Full Retirement Age (FRA), clients can wait to tap Social Security benefits until they’re entitled to maximum retirement payment benefit.

HOW DOES IT WORK?

The whole idea behind a Bridge Strategy is the Social Security check goes up, not even counting for COLA increases, by delaying when clients start collecting. And it works best when the Bridge Capital provides your clients a steady stream of income that is not affected by market fluctuations.

Using other assets in place of Social Security benefits when they retire — as a ‘bridge’ to delayed claiming — would allow clients, in essence, to buy a higher Social Security benefit.” -Andy Robertson

WHAT ARE THE ADVANTAGES?

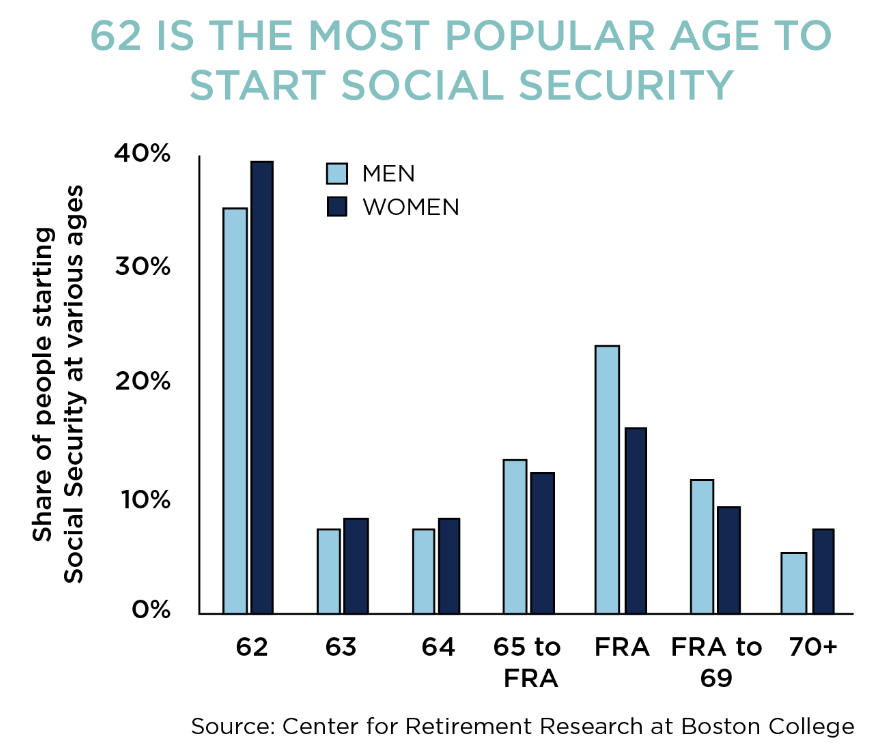

According to the Social Security Administration, very few people wait until their FRA to start collecting. But if retirees can wait, benefits can increase by as much as 76% between the ages of 62 and 70. That’s because benefits climb by as much as 8% each year they are delayed.

And there are even more advantages to using a Bridge Strategy like:

Guarantees: Provides your clients a guaranteed source of income not subject to market volatility.

Protection: Helps protect your clients from inflation eroding the value of retirement savings over time.

Flexibility: Bridge Capital offers flexibility in managing retirement income. By using a bridge strategy, clients can avoid locking in lower benefits from collecting Social Security earlier than necessary.

Enhanced Financial Security: By having Bridge Capital to rely on during the early years of retirement, clients reduce the risk of depleting savings or investment accounts too quickly. It provides a cushion of income to cover expenses until they can access full Social Security benefits.

The whole idea behind the Bridge Strategy is to drive up Social Security checks, not even counting for COLA increases, by delaying when you start collecting.

Optimize Retirement Planning: Incorporating Bridge Capital into your retirement income strategy allows for better financial planning. You can allocate other retirement assets and investments more strategically, knowing that your clients have a stable, guaranteed income source from the bridge payment. This can help you optimize the overall retirement income and help clients make informed decisions about other retirement accounts

Health Insurance Coverage: If clients retire before they’re eligible for Medicare at age 65, Bridge Capital can help cover health insurance premiums until eligibility. This ensures access to healthcare coverage without relying solely on savings.

IS A BRIDGE STRATEGY RIGHT FOR YOUR CLIENT?

Determining if a bridge plan is right for clients requires a thorough analysis of their specific financial situation, retirement goals, and risk tolerance. You should also take into account their current Social Security benefit amount and their expected benefit amount at different ages. Once you have a clear understanding of their situation, you can work with them to identify the right amount of Social Security Bridge Capital to supplement their retirement income.

CONCLUSION

A Social Security Bridge Strategy is a powerful tool that can help your clients boost retirement income and protect themselves against risk. Providing a guaranteed source of income, like an annuity that’s not affected by market volatility, can take the pressure off your clients to start taking Social Security benefits early. It also allows your clients to delay taking Social Security until a later age when they can receive a higher benefit amount. As a financial advisor, you can help your clients incorporate a Social Security Bridge Strategy into their retirement income plan to help achieve financial goals and enjoy a worry-free retirement.

For many, a bridge plan is the BEST way to achieve the retirement income experience most clients thought wasn’t possible.

Update Your Thinking to a 21st Century Retirement Income Plan.

Join us and learn how combining Annuities, Social Security, & Bridge Capital can build better, more fortified income plans for 50% less capital. Then you can really make your client’s dreams a reality.

Call Declan at 781-919-2337 and get started today.

Andy Robertson, CSSCS

Co-founder and Vice President, Training and Business Development

The Corporation for Social Security Claiming Strategies

As Head of Business Development & Training, Andy spends his days working with, coaching, and training some of the most accomplished, independent, retirement planning professionals in the country. Together, they introduce retiring Americans to the true power of one of the greatest retirement programs in existence today, Social Security.

His complete understanding of Social Security's unique ability to combat the erosive effects longevity, inflation and taxes have on retirement capital is the key to teaching advisors how to build fortified retirement income plans that minimize the likelihood their clients will run out of money during their lifetime.

With the vast majority of American households likely to fall short of their retirement savings goals, Andy recognizes successful retirement income planners must utilize their knowledge, training and tools to embrace the complexity of Social Security planning and leverage its ability to salvage middle America's retirement dreams.