As financial professionals, we understand the significance of offering comprehensive retirement planning solutions to our clients. A holistic approach ensures that their financial future is secure and well-structured. One vital component that often gets overlooked is estate planning.

More Americans are starting to realize the importance of estate planning, partially driven by inflation. In fact, 1 out of 4 Americans said that inflation caused them to see a greater need for estate planning. Overall, 64% of Americans think having a will is important, yet only 34% of Americans have an estate plan.

Let’s look at 6 reasons you should be including estate planning as an integral part of holistic retirement plans:

1. Preserving Wealth for Future Generations

One of the primary objectives of retirement planning is to preserve wealth and provide a legacy for future generations. But many people also establish a bequest, leaving a portion of their estates, or specific dollar amounts to a charity. Estate plans play a critical role in achieving this goal.

By helping clients establish properly drafted and funded estate plans, financial professionals ensure that assets are transferred efficiently and according to their clients’ wishes. Beneficiaries can avoid the costly, lengthy, and complicated process of going through probate to inherit the assets designed for them. This allows clients to leave a lasting impact on loved ones and chosen beneficiaries while minimizing potential conflicts and legal challenges.

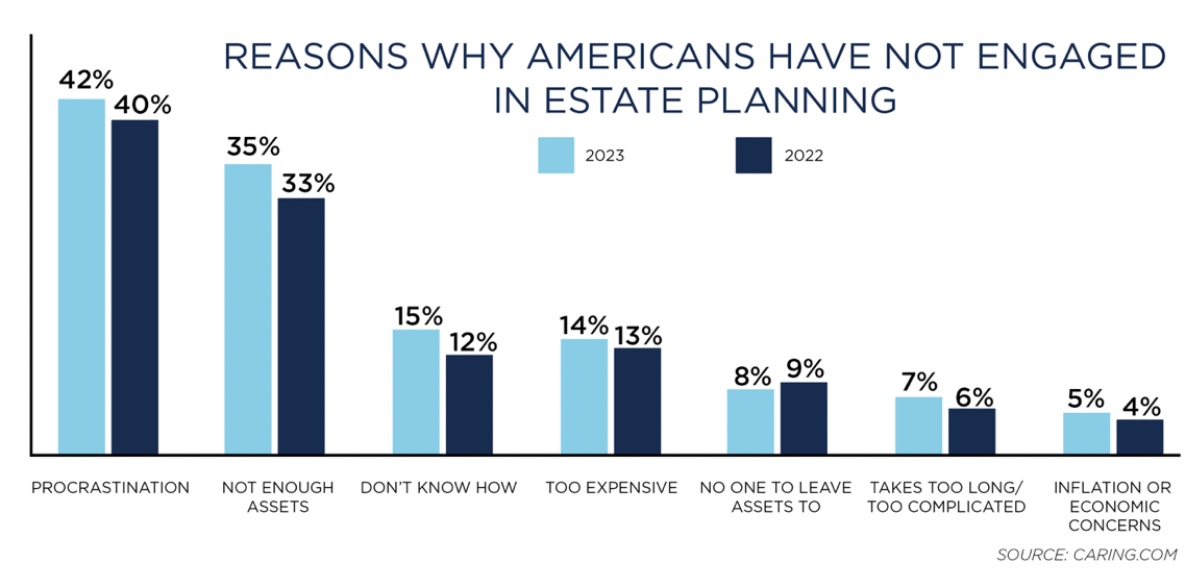

42% of Americans haven’t created a will due to procrastination, and more than 1 out of 3 people without a will say they don’t have enough wealth to leave behind.

(caring.com survey)

2. Minimizing Estate Taxes & Expenses

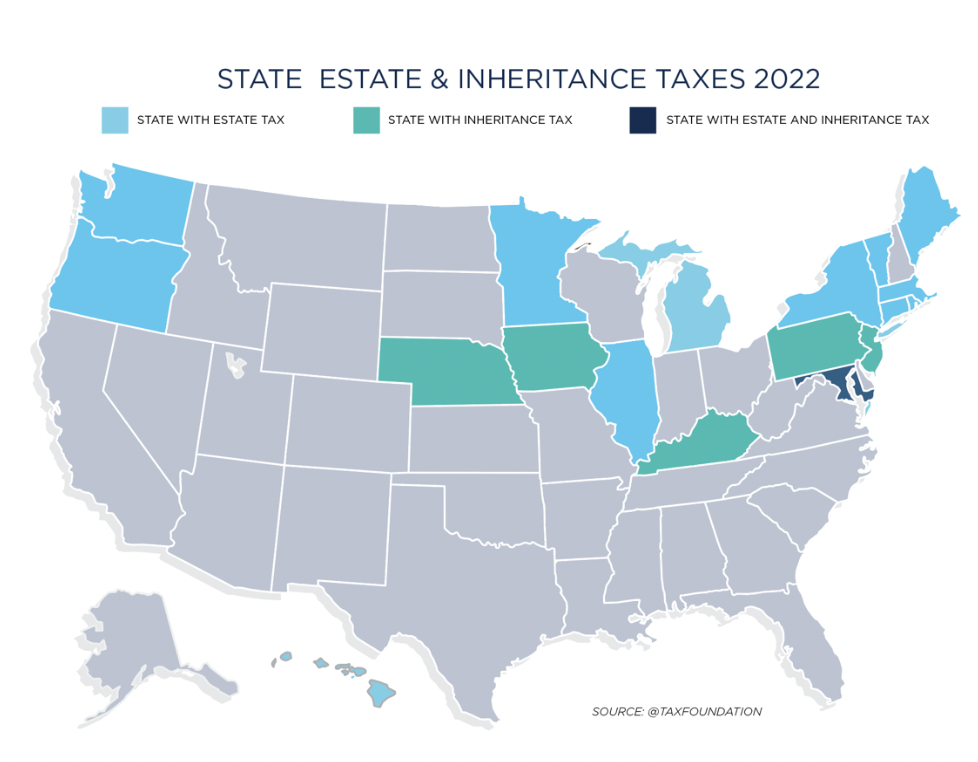

Estate taxes can significantly erode an individual’s wealth, reducing the amount of inheritance passed on to heirs. Besides a Federal Estate tax, which under the current exception limits most people will not be affected, 18 states also impose an Estate or Inheritance tax. Financial professionals who incorporate estate planning into retirement strategies can help clients explore various options to minimize estate taxes and administrative expenses.

Using techniques such as gifting strategies, irrevocable trusts, and charitable donations can be used to strategically reduce the tax burden on the estate, maximizing the inheritance left for beneficiaries.

3. Ensuring Smooth Asset Distribution

Estate plans encompass various legal documents, including wills and trusts, which lay out the distribution of assets according to the client’s wishes. Without a comprehensive estate plan, the distribution process may become complex, time-consuming, and contentious for surviving family members.

By offering estate planning services, financial professionals ensure a smooth and efficient transfer of assets and gives an opportunity to build a true bridge to the next generation.

Estate planning is a crucial element of a comprehensive financial & retirement strategy, but somehow is also the most overlooked component. This is a huge opportunity for your clients… and your business.

—Brian Donahue, President & CEO, DMI

4. Protecting Business Interests

Many of our clients are entrepreneurs or business owners. For these individuals, a well-designed estate plan is crucial in protecting their business interests and ensuring a smooth transition of ownership.

By developing a business succession plan within the estate planning framework, financial professionals can help business owners preserve their companies’ continuity and safeguard the hard work and legacy they’ve built over the years.

5. Addressing Incapacity and Healthcare Decisions

Holistic retirement planning should also take into account the possibility of incapacity due to illness or injury. Estate plans often include documents such as durable powers of attorney and advance healthcare directives, which allow clients to appoint trusted individuals to make financial and medical decisions on their behalf in case they become incapacitated.

By integrating these elements into a comprehensive retirement plan, financial professionals help clients retain control over their affairs during difficult times.

77% of pet owners designate a guardian for their furry friend.

—Trust & Will

6. Strengthening Client Relationships and Loyalty

Offering estate planning services as part of a holistic retirement plan demonstrates a commitment to your clients’ long-term financial well-being. By addressing their broader needs beyond investment strategies, financial professionals can build deeper relationships with their clients and foster loyalty.

Satisfied clients are more likely to refer their friends and family to you, thereby expanding your business and enhancing your reputation as a trusted advisor. You essentially become a referral magnate!

Conclusion

Incorporating estate plans into a holistic retirement planning approach is a strategic decision that benefits both clients and financial professionals. By preserving wealth for future generations, minimizing taxes, ensuring smooth asset distribution, protecting business interests, and addressing incapacity, estate planning becomes an essential element in achieving comprehensive financial security for clients.

As financial professionals, offering these services not only adds value to your offerings but also strengthens client relationships and fosters long-term loyalty, ultimately enhancing your overall business success.

Tyrell Jensen

VP of Annuity Sales

Tyrell Jensen has almost two decades of experience in annuity and life insurance sales, marketing, recruiting and business development. His work has focused on annuities, life insurance, and Long Term Care and how these products can be used to form a holistic plan for seniors in retirement.

Or Call 781-919-2368