WHY ASSET-BASED LTC DESERVES A PLACE IN YOUR PLANNING PLAYBOOK

Long-term care (LTC) is one of the most overlooked threats to a retirement portfolio. Advisors often focus on market volatility, taxes, and estate transitions — but few give equal weight to the financial shock a care event can cause.

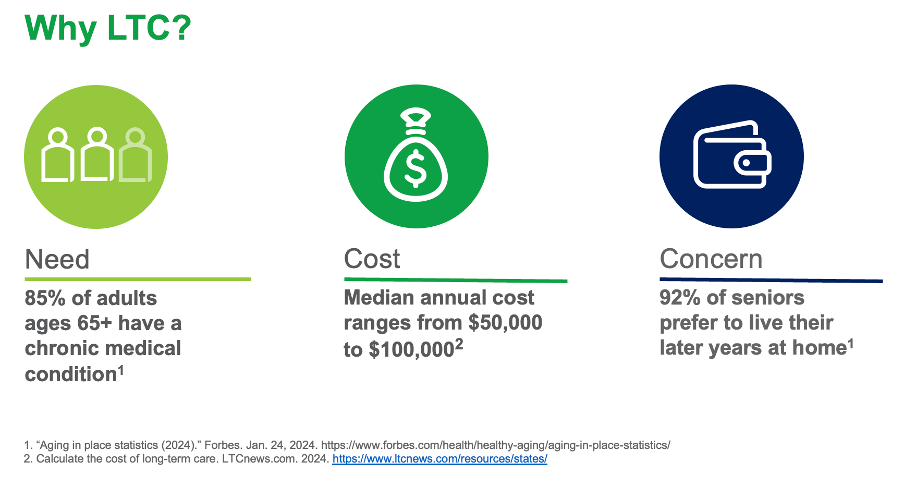

The statistics are hard to ignore:

- 85% of adults age 65+ have at least one chronic condition (Forbes)

- 92% want to age in place rather than move into a facility

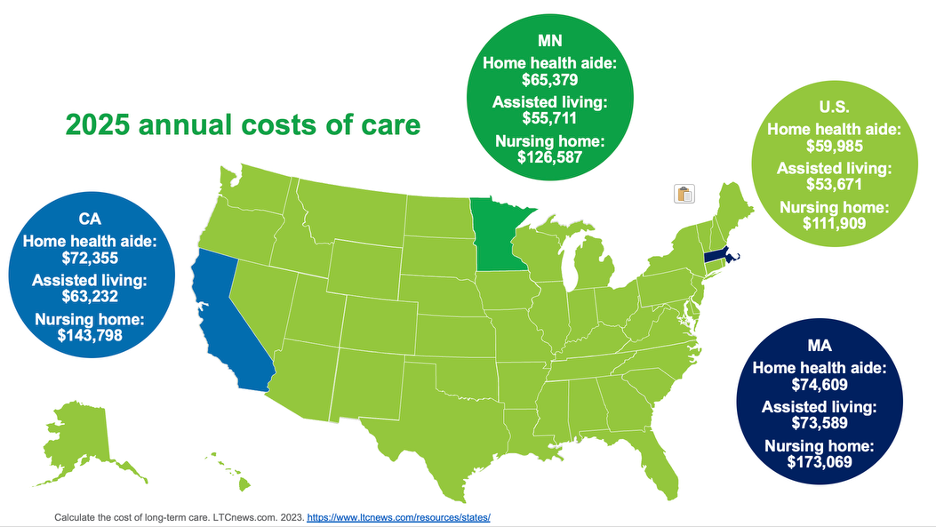

- The median annual cost of care ranges from $50,000 to over $100,000, depending on location and service level

These numbers aren’t just background noise — they represent real risks to client income streams, liquidity, and legacy goals.

“Failing to plan for long-term care isn’t just risky — it’s a threat to retirement itself.”

— ThinkAdvisor

THE PROBLEM WITH WAITING

In many households, LTC planning gets pushed aside because the topic is uncomfortable or the solutions feel too rigid. Traditional LTC insurance is still an option, but it comes with familiar friction points:

- Rising premiums over time

- “Use-it-or-lose-it” benefit structures

- Reimbursement requirements that create paperwork headaches

The result? Clients delay, avoid, or underfund the plan — leaving their assets exposed.

WHY TRADITIONAL LTC INSURANCE FALLS SHORT

Most advisors and clients are familiar with the traditional LTC insurance model: use-it-or-lose-it policies, rising premiums, and reimbursement hassles. These limitations often lead clients to delay or avoid planning altogether, leaving their assets exposed.

But there is a better option.

“With a properly structured asset-based LTC policy, clients don’t have to choose between care and legacy. They can have both.” -Brian Donahue, DMI President & Founder

A NEW WAY TO THINK ABOUT CARE PLANNING

Enter asset-based long-term care — also known as hybrid LTC. Instead of paying ongoing premiums for a benefit that may never be used, clients reposition existing assets into a single strategy that can deliver:

- Cash benefits for care (no receipts required)

- A death benefit for heirs if care isn’t needed

- Return-of-premium options for flexibility and liquidity

- Potential tax advantages that make the plan even more efficient

It’s not just a product swap — it’s a shift in the conversation. Advisors can now frame LTC as a multi-purpose financial asset, not a sunk cost.

THE TAX ANGLE ADVISORS SHOULDN’T OVERLOOK

Asset-based LTC solutions often open the door to tax-efficient funding:

- Premium deductions based on client age and income thresholds (IRC Section 213(d))

- HSA dollars applied toward eligible portions of premiums

- Business-owner strategies that may allow for partial or full deductions at the corporate level

For clients already itemizing deductions or using advanced tax planning, this can turn an LTC plan from a necessary expense into a strategic allocation.

“LTC insurance premiums are considered medical expenses and may be deductible under Section 213(d) of the Internal Revenue Code.”

— IRS.gov

Designed for Fiduciaries. Made for Results.

This isn’t just about features. It’s about alignment.

This IUL was built for professionals who lead with integrity and expect more from the products they recommend.

Whether you’re an insurance agent, investment advisor, or hybrid rep, this solution:

- Delivers transparency and simplicity

- Provides real-world outcomes clients understand

- Strengthens portfolios, income plans, and legacy strategies

And because it’s easy to explain—it’s easier to close.

“LTC insurance premiums are considered medical expenses and may be deductible under Section 213(d) of the Internal Revenue Code.”

— IRS.gov

BRINGING IT INTO THE CONVERSATION

The best time to integrate LTC planning isn’t when a client is already facing a health event — it’s when portfolios are healthy, retirement income is in focus, and asset repositioning can be done strategically.

As the advisor, your role is to:

- Identify the gap — quantify how much care could cost vs. current coverage or reserves

- Educate on the options — including asset-based models that preserve liquidity and legacy

- Show the math — demonstrate how repositioning an underperforming asset can multiply its value for care

WANT TO SEE HOW THIS WORKS IN PRACTICE?

On August 21 at 12 PM ET, I’ll be hosting a free training for financial professionals on integrating asset-based LTC into client portfolios.

We’ll cover:

- How cash indemnity benefits change the planning conversation

- Where to look for “lazy” assets that could be leveraged for LTC

- Case designs for individuals, business owners, and high-income households

- Ways to align LTC planning with tax and estate strategies

This is a planning-focused session with real examples you can use right away.

DON’T MISS THIS OPPORTUNITY TO UPGRADE YOUR APPROACH

Long-term care isn’t going away. But how we plan for it—and how clients perceive it—is evolving fast.

Be the advisor who offers clarity, strategy, and confidence in one of the most emotionally charged areas of retirement planning.

JOSHUA RHEM

VICE PRESIDENT – LIFE SALES

Joshua Rhem brings 15+ years of experience in insurance and investment services, including roles as an RIA, producer, and wholesaler. He’s passionate about making insurance a core pillar of smart financial planning—and laser-focused on helping advisors turn obstacles into opportunities. Whether it’s strategy, support, or swift answers, Josh shows up ready to help brokers, agents, and advisors grow their business and deliver real value to clients.

Or Call 781-919-2325