In the world of financial planning and retirement strategies, one topic that often takes center stage, especially when dealing with clients in the retirement red zone (the critical five years before and after retirement), is Sequence of Returns Risk. Understanding and effectively managing this risk is paramount to ensuring your clients’ financial security during their golden years. In this blog, we’ll delve into what sequence of returns risk is, how it impacts clients in the retirement red zone, and strategies to mitigate its effects, including the use of fixed annuities.

WHAT IS SEQUENCE OF RETURNS RISK?

Sequence of returns risk refers to the danger of encountering a series of negative investment returns at the wrong time—typically early in retirement. These poor returns can deplete the portfolio faster than expected, leaving retirees vulnerable to outliving their savings. It’s essential to grasp that the order in which returns occur can significantly impact the longevity of a retirement portfolio.

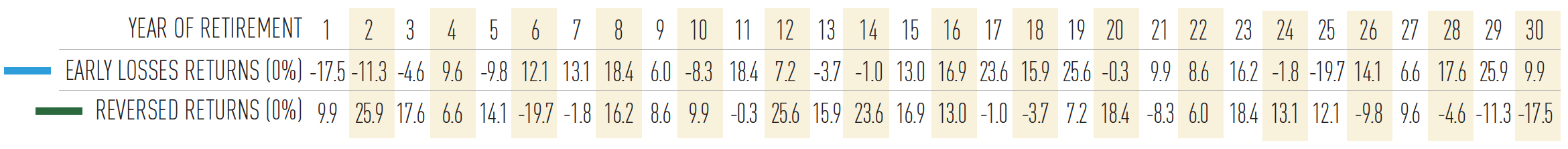

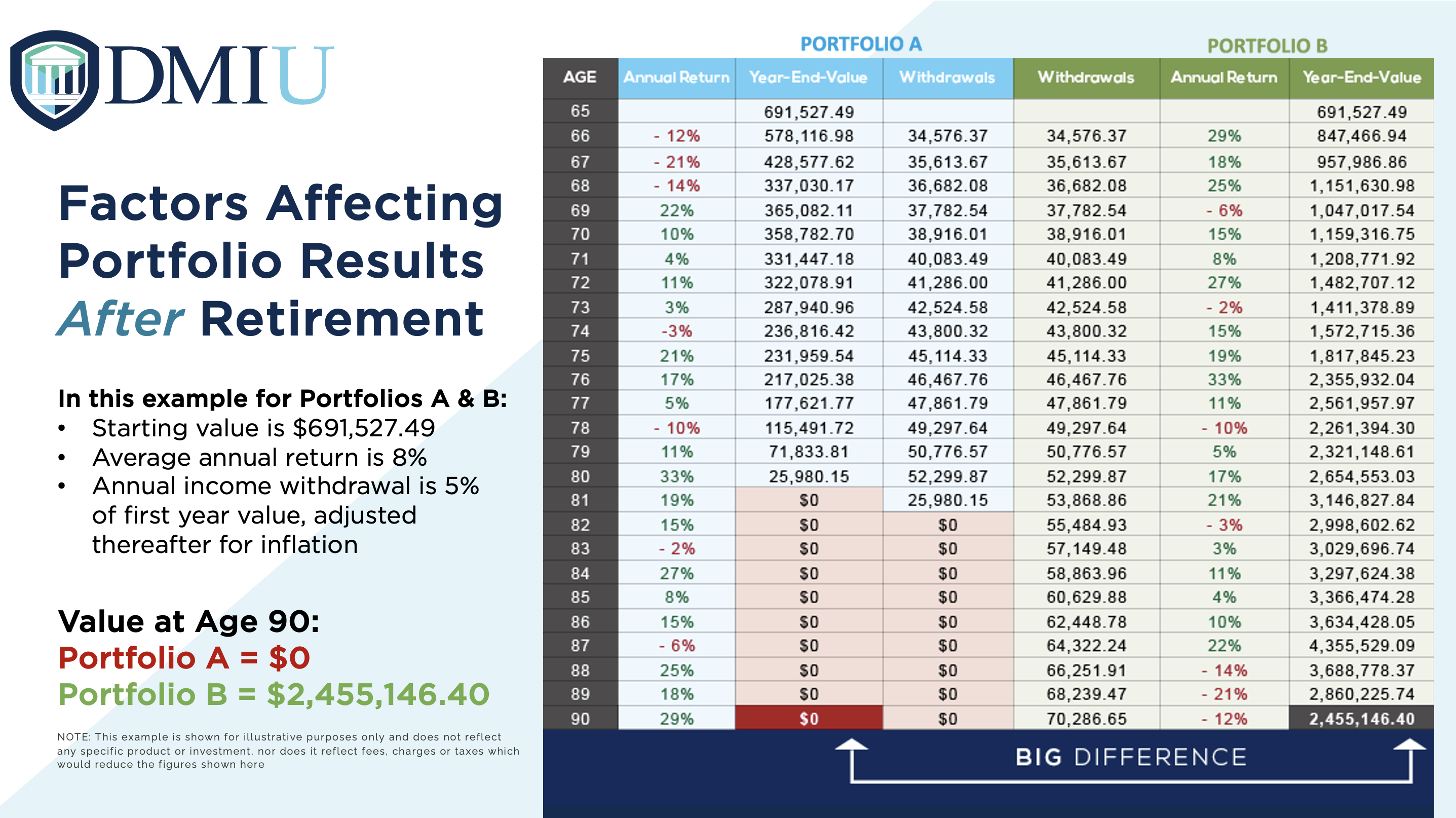

Figure 1: Sequence of Returns Success or Failure

Sequence of returns can mean the difference between making your clients’ retirement dreams come true… or their worst retirement nightmare.

IMPACT ON CLIENTS IN THE RETIREMENT RED ZONE

Clients in the retirement red zone face a delicate balance between safeguarding their assets and generating enough income to sustain their desired lifestyle. Sequence of returns risk is most pronounced during this period because a market downturn early in retirement can have lasting repercussions. Here’s how it affects clients:

Portfolio Depletion: A series of negative returns just before or at the onset of retirement can erode the portfolio’s value rapidly, making it challenging to recover.

Reduced Income: Clients may need to withdraw a higher percentage of their portfolio to meet living expenses during market downturns, potentially depleting assets further.

Longevity Concerns: With the risk of running out of money, clients may live in fear of outliving their savings, impacting their retirement experience.

The majority of Americans (61%) say they are more afraid of running out of money than they are of death, according to a 2023 Annual Retirement Study.

MITIGATING SEQUENCE OF RETURNS RISK

As advisors, our primary goal is to help clients mitigate Sequence of Returns Risk and help clients try to achieve financial peace of mind during retirement. Here are strategies to consider:

Diversification: Diversifying the portfolio across different asset classes can help reduce the impact of poor returns from a single investment. A well-diversified portfolio can be more resilient during market downturns.

Take Risk Off the Table: Your clients don’t want to rely on the ups and downs of the market for the income they need to cover their basic living expenses in retirement, so look at income sources that guarantee these needs are met. These sources could likely include social security, pensions, annuities, and other “conservative” investments such as TIPS or bonds.

Fixed Index Annuities: FIAs can be a valuable tool to protect against sequence of returns risk. They offer a zero floor and guaranteed income streams, much like a pension, that can act as a stable source of cash flow during market volatility.

- Minimum interest guarantee

- Tax-deferred growth

- Guaranteed income for life

- Access to money*

- Withdrawal charge waivers for life’s “just in case” moments

- Guaranteed death benefit

- Diversification

- No upfront sales charges or administrative fees

- Immediate Annuities: These provide regular, guaranteed payments immediately after the premium is paid, offering a predictable income stream.

- Deferred Annuities: Deferred annuities let clients accumulate funds over time and then convert them into guaranteed income later.

Regular Portfolio Rebalancing: Periodic portfolio rebalancing helps maintain the desired asset allocation and reduces the risk of overexposure to a specific asset class.

Lowering Expenses: Putting off dream vacations or not buying that vacation home for a couple of years could help bolster a retirement portfolio and increase how long the money will last. Encourage clients who are considering moving to do some research determining which locales will meet their retirement goals. AARP, US News and World Report, and Kiplinger frequently publish lists of the best, affordable places to retire.

Incorporating these strategies into your current financial planning process can help your clients navigate the challenging waters of sequence of returns risk and enjoy a more secure retirement.

Remember, every client’s situation is unique, so tailor your approach to their individual needs and goals. By addressing sequence of returns risk proactively, we can help our clients achieve their retirement dreams with confidence and peace of mind.

Get top sales techniques for positioning

Sequence of Returns Risk.

Claim your seat NOW!

Erick Lindewall

VP of Annuity Sales

Erick Lindewall is an industry veteran with 30 years of experience, including over 20 years as an External Variable Annuity Wholesaler. He as worked with financial advisors in all major distribution channels. Erick has been recognized as a sales and relationship management leader multiple times during his wholesaling career.

Or Call 781-919-2351