Four Threats. One Answer.

Let’s be honest: most retirement strategies out there look the same.

Layer on some stocks, sprinkle in a bond ladder, add a little Social Security guesswork, and hope your client doesn’t live past 85 or get sick. That’s the plan?

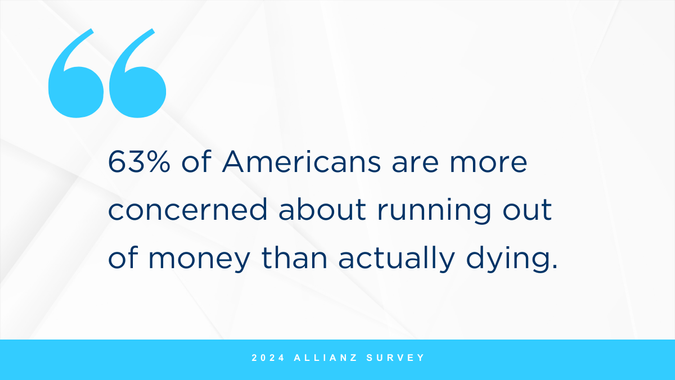

Meanwhile, your clients are quietly panicking about four things:

- Living too long.

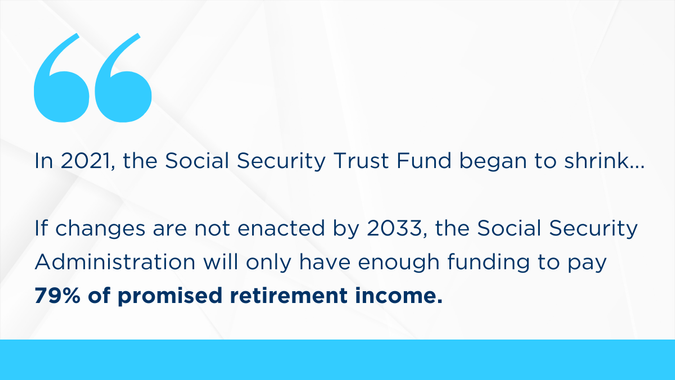

- Losing Social Security.

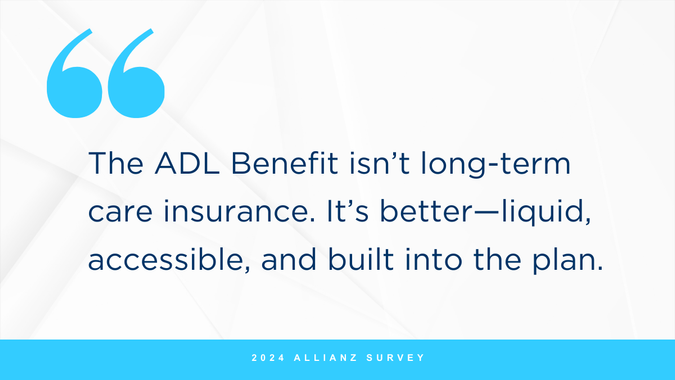

- Getting sick without coverage.

- Leaving nothing behind.

Now imagine walking into that conversation with one solution that helps iron out those four issues.

We’re talking about a next-generation Fixed Index Annuity (FIA) with a rider that defuses every major retirement threat with the precision of a mission-trained asset. You won’t find it on most platforms. In fact, less than 2% of financial professionals have access to it.

And that’s why you should.

Here’s how this exclusive FIA fires back with a first-of-its-kind 4-in-1 rider:

LONGEVITY RISK: COVERED FOR LIFE

Running out of money is the nightmare your clients won’t say out loud. This FIA helps turn that fear into peace of mind—with a lifetime income benefit powered by a Benefit Base that grows at 200% of net credited interest.

That’s not just income. That’s built-in resilience.

SOCIAL SECURITY CUTS: OFFSET WITH PRECISION

By 2033, Social Security is projected to pay just 79% of promised benefits. If a government-mandated reduction of 3% or more hits, this FIA activates a 12-year income stream to help fill the gap—automatically.

HEALTH SHOCKS: LIQUIDITY WHEN IT’S NEEDED MOST

With 70% of retirees expected to need some form of care, long-term care costs can crush even the best-laid plans. This FIA’s ADL Benefit pays out over seven years if the client can’t perform 2 of 6 daily living activities—no nursing home requirement and no strings attached.

LEGACY PLANS: BACKED BY AN ENHANCED EXIT STRATEGY

When a client passes what they leave behind matters. This FIA offers an Enhanced Death Benefit that could significantly exceed the accumulation value—paid out over five years to maximize what’s left for loved ones.

Why This Matters for You

Anyone can serve up the usual suspects. But this? This is next-level planning with classified-grade access.

This FIA lets you:

- Differentiate instantly in a commoditized market

- Add massive value to clients worried about the unknown

- Build deeper trust with holistic risk-mitigation

- Create predictable income streams and legacy benefits

Want in?

This FIA isn’t mass-market. It’s not for every client—or every advisor. But if you’re serious about standing out and delivering next-level solutions, it’s time to get the full briefing.

Contact Declan at 781-919-2337

Email: ddonahue@dmi.com

Book a 15-minute call: https://calendly.com/dmiddonahue

Retirement is full of risk. You just found the weapon to fight back.

Declan Donahue, CSSCS®

DMI Sales Representative

Or Call 781-919-2351